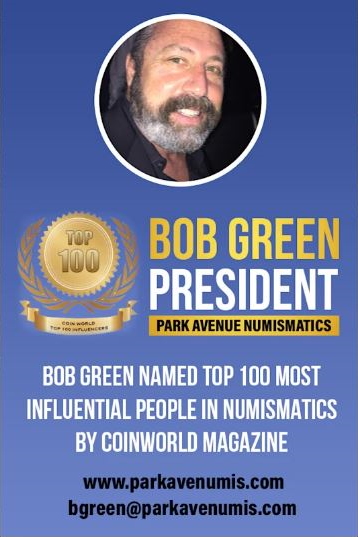

Park Avenue Numismatics

5084 Biscayne Blvd, Suite 105

Miami, FL 33137

Toll Free: 888-419-7136

Secure Private Ordering

We use the latest online security processing,

so your order is safe & private.

We DO NOT disclose any customer

information to ANY third party company.

Our customer privacy is our priority.

Over 30 Years Experience

Park Avenue has over 30 years

experience buying and selling

Rare Coin and Precious Metals.

We have the knowledge and

ability to provide our customers

with the best products and services.

Tide is turning: 'You have to be in gold/silver'

Gold last traded at $1,728 an ounce. Silver at $25.16 an ounce.

NEWS SUMMARY: Precious metal prices eased Tuesday as higher interest rates boosted the dollar. U.S. stocks fell as investors took some profits in shares that will benefit from the reopening of the economy.

KITCO--"A lot happened in the gold space over the last week. And the tides may finally be turning for the precious metals. Here's a breakdown of the top three stories.

1. The Federal Reserve kept its monetary policy unchanged but revised up its economic and inflation expectations. The Fed now sees U.S. GDP at 6.5% and inflation at 2.4% in 2021. In response, gold finally rose as the Fed signaled that it plans to keep rates near zero through 2023. Fed Chair continued to refer to any price spikes as transitory while ignoring rising yields. As all of this was being digested, gold breached above $1,750 an ounce - almost a 3-week high.

2. Mark Mobius, founder of Mobius Capital Partners, said that investors have to be in precious metals, citing everything from gold to silver, platinum, and palladium. He described the precious metals as the best 'long, long term investment simply because they represent a form of currency.'

3. Ray Dalio, founder of Bridgewater Associates, warned investors that high levels of debt in the U.S. could trigger 'shocking' tax changes that might involve prohibitions against assets like gold and bitcoin. Dalio gave examples from the 1930s and 40s when the Fed was able to control yields because gold was banned in the U.S. Dalio once again said that cash is 'trash' and told investors to buy 'any stuff that will equal inflation or better.'"