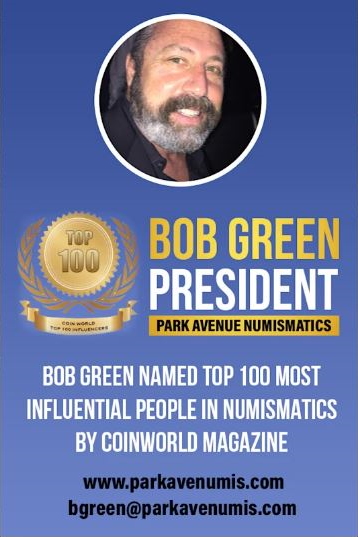

Park Avenue Numismatics

5084 Biscayne Blvd, Suite 105

Miami, FL 33137

Toll Free: 888-419-7136

Secure Private Ordering

We use the latest online security processing,

so your order is safe & private.

We DO NOT disclose any customer

information to ANY third party company.

Our customer privacy is our priority.

Over 30 Years Experience

Park Avenue has over 30 years

experience buying and selling

Rare Coin and Precious Metals.

We have the knowledge and

ability to provide our customers

with the best products and services.

Regional Bank Crisis Spreads To Big Banks

5.4.23 - Regional Bank Crisis Spreads To Big Banks

Gold last traded at $2,050 an ounce. Silver at $26.06 an ounce.

Regional Bank Crisis Spreads To Big Banks As PacWest, US Bancorp Tumble, Stocks Dump Amid Widespread Liquidations -Zero Hedge

Two days ago, on May 2, in the aftermath of the FRC take-under by JPM which Jamie Dimon praised (of course) as a deal proving that the "system works as it should", and predicted that the bank crisis is now almost over, a forecast which the Fed chair reiterated yesterday (just before all hell broke loose), we warned that the "banking crisis is baaaack" for the simple reason that by bailing out FRC, up to $75 billion in Fed reserves would be drained from the system pushing small banks back to their reserve constraint and forcing another market puke and/or Fed bailout.

And as events less than 24 hours later proved conclusively, we were again right.

Early this morning, after its stock crashed as much as 60% and falling to a record low in the afterhours session following a Bloomberg report that it was seeking to sell itself or raise capital and sparking concerns that it was the next insolvent bank, California's PacWest Bancorp (it's always a California bank for some odd reason), confirmed that it was indeed in talks with several potential investors, and said core deposits have increased since March in a desperate attempt to calm markets after the stock rout made it the new focal point of concern over the health of US regional lenders.

"The bank has not experienced out-of-the-ordinary deposit flows following the sale of First Republic Bank and other news," PacWest said in a statement after the stock's post-market plunge. "Our cash and available liquidity remains solid and exceeded our uninsured deposits."

Sadly for PACW, in a world where a bank bringing attention to its balance sheet only invites bear raids and massive shorting, the bank failed to rebound and this morning it plunged as much as 48%, after being halted twice, and was last trading down 42%.