March silver futures bears still have the overall near-term technical advantage. However, a choppy six-week-old uptrend is in place on the daily bar chart. Silver bulls' next upside price breakout objective is closing prices above solid technical resistance at the October high of $15.055 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at the November low of $13.985. First resistance is seen at last week’s high of $14.915 and then at $15.00. Next support is seen at last week’s low of $14.615 and then at $14.50.

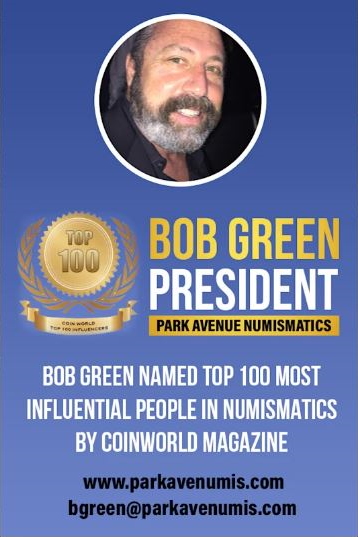

Park Avenue Numismatics

5084 Biscayne Blvd, Suite 105

Miami, FL 33137

Toll Free: 888-419-7136

Secure Private Ordering

We use the latest online security processing,

so your order is safe & private.

We DO NOT disclose any customer

information to ANY third party company.

Our customer privacy is our priority.

Over 30 Years Experience

Park Avenue has over 30 years

experience buying and selling

Rare Coin and Precious Metals.

We have the knowledge and

ability to provide our customers

with the best products and services.

Gold Pushes To 5-Mo. High As Stock Mkts Continue Melt-Down

Gold prices are solidly up and hit a five-month high in midday trading Monday, on safe-haven buying interest heading into the Christmas holiday. Slumping U.S. stock indexes that again hit new lows for the year are prompting safe-haven demand for the yellow metal. A lower U.S. dollar index today is also working in favor of the precious metals market bulls. February gold future swere last up $13.30 an ounce at $1,271.40. March Comex silver was up $0.123 at $14.825 an ounce.

February gold futures today pushed above the 200-day moving average for the first time since last May, which is another bullish chart development.

There is marketplace unease over the U.S. government’s partial shutdown that could last a while. U.S. Treasury Secretary Steve Mnuchin contacted large U.S. banks over the weekend, which confirmed to Mnuchin they have liquidity, following large losses in the U.S. stock market last week that pushed stock indexes to new lows for the year. Mnuchin’s phone calls to the banks raised eyebrows and could have had the opposite effect of his intended efforts to calm the marketplace.

European and Asian stock markets were also mostly lower overnight. U.S. stock and financial markets close early today for the Christmas holiday. Most world markets are closed on Tuesday for Christmas Day. The markets are also a bit concerned about turmoil in the Trump administration that has seen the president’s top staff resign, including his defense secretary. The other key outside market today sees Nymex crude oil prices lower and hitting a 17-month low of $44.40 a barrel.

Technically, gold prices are very close to pushing above the key 200-day moving average for the first time since last May. The bulls have the firm overall near-term technical advantage. Prices are in a six-week-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close in February futures above solid resistance at the July high of $1,284.10. Bears' next near-term downside price breakout objective is pushing prices below solid technical support at $1,236.50. First resistance is seen at $1,275.00 and then at $1,280.00. First support is seen at today’s low of $1,260.00 and then at $1,250.00.