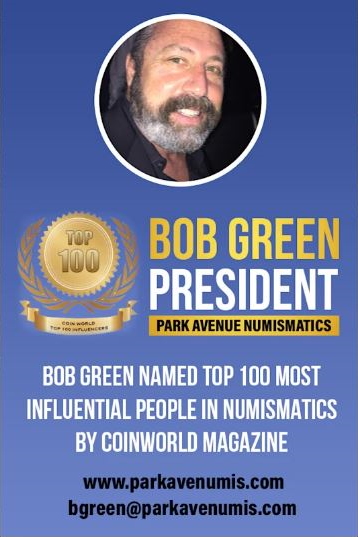

Park Avenue Numismatics

5084 Biscayne Blvd, Suite 105

Miami, FL 33137

Toll Free: 888-419-7136

Secure Private Ordering

We use the latest online security processing,

so your order is safe & private.

We DO NOT disclose any customer

information to ANY third party company.

Our customer privacy is our priority.

Over 30 Years Experience

Park Avenue has over 30 years

experience buying and selling

Rare Coin and Precious Metals.

We have the knowledge and

ability to provide our customers

with the best products and services.

Blackstone Defaults On $562MM CMBS As It Keeps Blocking Investor Withdrawals From $71BN REIT -ZeroHedge

3.3.23 - The Carnage is Coming Fast and Furious

Gold last traded at $1,855 an ounce. Silver at $21.25 an ounce.

Blackstone Defaults On $562MM CMBS As It Keeps Blocking Investor Withdrawals From $71BN REIT -ZeroHedge

Now that soaring rates have burst the commercial real estate bubble, the carnage is coming fast and furious.

This morning Bloomberg reports that Wall Street's largest commercial real estate landlord, private equity giant Blackstone, has defaulted on a 531 million euros ($562 million) bond backed by a portfolio of offices and stores owned by Sponda Oy, a Finnish landlord it acquired in 2018.

While the PE firm had sought an extension from holders of the securitized notes to allow time to dispose of assets and repay the debt, the surge in market volatility triggered by the war in Ukraine and rising interest rates interrupted the sales process and bondholders voted against a further extension, the Bloomberg sources said.

And since the security has now matured and has not been repaid, loan servicer Mount Street has determined that an event of default has occurred, according to a statement Thursday. The loan will now be transferred to a special servicer.

"This debt relates to a small portion of the Sponda portfolio," a Blackstone representative said in an emailed statement. "We are disappointed that the servicer has not advanced our proposal, which reflects our best efforts and we believe would deliver the best outcome for note holders. We continue to have full confidence in the core Sponda portfolio and its management team, whose priority remains delivering high-quality retail and office assets."